Disclaimer: The information provided in this article is for educational purposes only and should not be considered as financial advice.

What is token burning? It sounds harsh, but it is a significant process in certain blockchains and projects. It involves the removal of a certain amount of token supply, but why do this and is it really necessary? Does it benefit the crypto market? Spoiler alert, it creates a deflationary mechanism within the ecosystem. Let’s take a closer look at what burning cryptocurrency is and what it does.

Table of Contents

- The Token Burning Process – What Does This Mean?

What is a Token Burn?

To put it simply, token burning is a permanent removal of a certain number of tokens from circulation. Token burns are conducted almost always for strategic purposes and are carried out by crypto projects or platforms.

What happens when you eliminate some tokens from the market? Coin burning can create a scarcity of assets and therefore raise the prices and value of the remaining ones.

How Does Token Burning Work?

How token burning is addressed depends on the project or platform. However, it usually follows these steps:

- To burn or not to burn – The team on the crypto project or platform must first decide whether or not to conduct the burning process. They do this by looking at the token economy and analyzing inflation and whether or not to reward holders.

- Burn address – The project or platform then needs to create a burn address or black hole address. This address is a public one but is inaccessible and does not have a corresponding private key.

- Transfer burn tokens – The team then sends the designated amount of tokens to burn to the burn address. Be aware that once the tokens are transferred, there is no way to retrieve or access them.

- Public verification – The crypto space is all about transparency, so the token burn will be recorded on a blockchain for all to see. Users can verify the burn if necessary by checking the transaction details for proof of burn.

- Burn results – After there is a permanent reduction in supply, the team and the public will see the benefits.

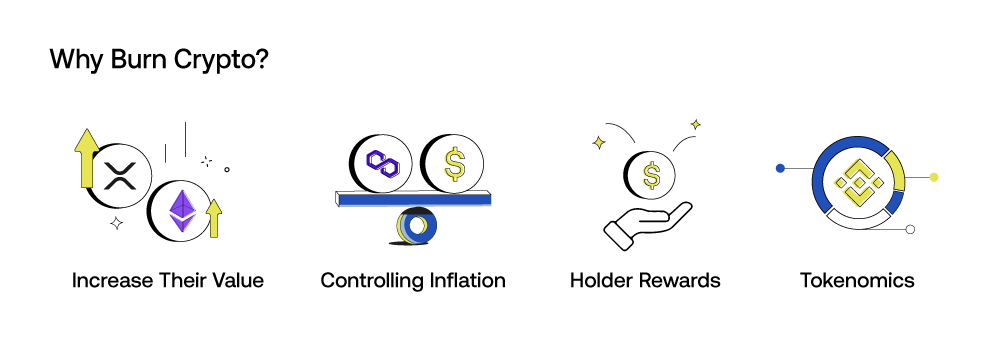

Why Burn Crypto?

- Increase Their Value

When there’s too much of something, the asset’s value typically decreases. Value appreciation can happen when you boost scarcity, and you do this by burning supply. When there is a limited supply the demand may then increase, and we can see a rise in price. - Controlling Inflation

Similar to the first point, burning crypto can help with inflation. If the supply keeps increasing, devaluation happens and so does diminished investor confidence. Burning crypto can help balance the economy. - Holder Rewards

Another big reason why you would want to burn cryptocurrency tokens is to reward their holders. How does burning benefit existing token holders? When the supply decreases, the value of the existing tokens and percentage goes up, which could give more value to what the holders have. - Tokenomics

Tokenomics pertains to the structure and design of a token’s ecosystem. Token burning can improve tokenomics by incorporating all of the above points and ensuring that token holders have a more significant stake in projects to influence the economy.

Benefits of Burning Tokens

- Supply management and stability in the ecosystem – the circulation supply is controlled to boost the value

- Network efficiency – The transaction speed and scalability of a congested blockchain network could improve due to having fewer tokens to process

- Network security – A token burn can increase a blockchain’s security by implementing a proof-of-burn mechanism. This mechanism is when tokens are burned as proof-of-stake, which can in turn increase the cost and efforts of cyber attacks.

What does it mean when tokens are burned as proof-of-stake? Holders can show commitment to the ecosystem by permanently destroying a certain number of tokens. The act of burning tokens acts as evidence of their stake in the network, and they are granted certain privileges or responsibilities (similar to rewards) - Incentivization – As the supply decreases and the value of the token goes up, it could incentivize its usage, make it more desirable, and it can even drive adoption, which only benefits the crypto project. Not to mention, it also demonstrates a project’s commitment to the long-term preservation and sustainability of the token value.

Drawbacks and Risks to Token Burning

- Permanence – Once the tokens are burned, the effects are permanent. There is no recovering them or reversing the process.

- Consensus and support – Even if the majority of the team or holders reach a consensus for the token burn, it doesn’t mean everyone supports it, which could cause dissent in the community.

- Market volatility – The burn could also cause short-term market volatility. Scarcity could lead to rapid price fluctuations, and price speculation, which could impact investor confidence.

- Community and utility impact – If token holders are not adequately informed before the token burning, it could lead to discontent and a lack of trust. As for the utility, it can be impacted if there is excessive burning, which could severely limit supplies and hinder the use or wider adoption.

- Manipulation risks – If token burns are not executed with transparent burn proof, it opens opportunities for misleading claims, fake burning events, or misallocation of tokens, which can harm the project’s reputation and trust.

Conclusion

Token burning may sound severe, but the process actually plays a very significant role in shaping the cryptocurrency economy. It gives projects, platforms, and holders more control over tokenomics, supply management, and value appreciation.

While crypto burning can yield many benefits, there are still drawbacks to be aware of. Make sure the coins burnt are deliberate, as the process cannot be reversed, and there is consensus from the community, holders, team, or platform.

Related Articles:

- Stablecoins – What are They and What Do They Do?

- What are Altcoins?The Alternative to Bitcoin

- Meme Coins – A Joke or Are They More?